Financial assets

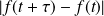

In this example we will show the probability distribution of the fluctuation

of exchange rate over a period of

of exchange rate over a period of

minutes, the rate variations can be considered as Gaussian approximation. The mean observation shows that for

minutes, the rate variations can be considered as Gaussian approximation. The mean observation shows that for

minutes, the variations are strongly non-gaussian.

minutes, the variations are strongly non-gaussian.

Information[1]

Information[1]This is very important for risk assessment: the non-Gaussian nature of the probability distribution is so pronounced that using a Gaussian approximation would lead to significant errors.